Calculate Your Mortgage in Brea, California

Rate History

Are you a first time Home buyer?

Our First Time Home Buyer Assistance Program is just what you need.Mortgage Loan Calculator for Home Purchases and Refinancing in Brea, California

At Summit Lending, we recognize that purchasing a home or refinancing a mortgage in Brea, California, is a major financial decision. That’s why we’ve developed an intuitive, up-to-date mortgage loan calculator to assist residents of Brea and beyond in estimating monthly payments and planning budgets effectively. Whether you’re a first-time home buyer in Orange County, looking to upgrade to a larger property in Brea’s family-friendly neighborhoods, or aiming to reduce monthly payments through refinancing, our tool delivers personalized results using current interest rates and loan terms. Based in Tremonton, Utah, Summit Lending proudly serves clients across California, Utah, Texas, Idaho, and Wyoming with over 50 years of combined experience in the mortgage industry. We’re here to help Brea residents navigate their mortgage journey with confidence.

Calculate Your Mortgage Loan in Brea, CA

Understanding your mortgage payment is a critical step in the home buying process. Using a mortgage calculator helps you budget, confirm affordability, and plan financially for the future. For Brea residents, where the median home price is approximately $850,000 as of 2023 (according to Redfin data), having a clear picture of your payments is essential in a competitive housing market like Orange County.

Calculating Your Mortgage Payment

Your monthly mortgage payment in Brea will typically include the following components, often referred to as PITI, which you should consider when using our home loan calculator:

- Principal (P): The portion of the loan amount you repay each month.

- Interest (I): The cost of borrowing the principal, based on your interest rate.

- Taxes (T): Property taxes, which in Brea average around 0.75% of home value annually, per the Orange County Tax Assessor.

- Insurance (I): Homeowners insurance and, if applicable, private mortgage insurance (PMI) for down payments less than 20%.

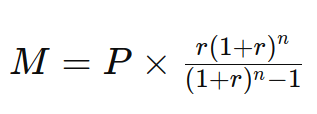

Mortgage Payment Formula with Our Home Loan Calculator

Use this formula to calculate your fixed-rate home loan payment (denoted as 'M' for mortgage) each month:

Where:

- P = Principal loan amount.

- r = Monthly interest rate (annual rate divided by 12).

- n = Total number of payments (loan term in years multiplied by 12).

Expected Loan Payment Costs in Brea

For example, if you secure a 30-year loan for $700,000 (a common loan amount given Brea’s home prices) at a 6.5% interest rate (reflecting 2023 market averages per Freddie Mac), your monthly principal and interest payment would be approximately $4,422. Adding Brea’s property taxes (around $525/month for a $700,000 home), homeowners insurance (about $150/month), and potential PMI, your total monthly payment could exceed $5,100. Use our Mortgage Calculator for a precise breakdown tailored to your situation in Brea, CA.

Why Use a Mortgage Loan Calculator for Brea Properties?

The mortgage process can be daunting, especially in a high-demand market like Brea, where factors such as interest rates, loan terms, down payments, and local property taxes significantly impact your monthly costs. Our mortgage loan calculator simplifies this by providing clarity. Here’s why Brea residents should use our tool:

- Estimate Monthly Payments: Enter your loan amount, interest rate, and term to see potential monthly costs.

- Compare Loan Options: Test scenarios like a 15-year versus a 30-year mortgage to match your budget.

- Plan for Additional Costs: Factor in Brea’s property taxes, insurance, and PMI for accurate estimates.

- Understand Refinancing Savings: Explore how refinancing at a lower rate or different term can reduce costs over time.

Our calculator uses real-time data to reflect current market conditions, ensuring Brea residents make informed decisions. Visit our Loan Calculator page to start exploring your options today.

Home Buying in Brea, California

Brea, nestled in the heart of Orange County, offers a compelling mix of suburban tranquility and urban accessibility, making it an ideal location for home buyers. With a population of around 47,000 (per the U.S. Census Bureau, 2023), Brea boasts top-rated schools in the Brea-Olinda Unified School District, a low crime rate, and a vibrant downtown with dining and shopping at places like the Brea Mall. Its proximity to major employment centers in Anaheim, Fullerton, and Los Angeles—coupled with easy access via the 57 Freeway—makes it attractive for professionals and families alike. According to the California Association of Realtors, Brea’s median home price in 2023 hovers around $850,000, reflecting a 5% year-over-year increase due to high demand and limited inventory in Orange County.

For first-time buyers or those relocating to Brea, using our loan calculator helps determine how much home you can afford amidst these rising prices. Summit Lending offers specialized assistance for first-time home buyers and can guide you through the pre-approval process to strengthen your offer in Brea’s competitive market. Connect with one of our Loan Officers for personalized advice tailored to Brea’s unique housing landscape.

Refinancing Your Mortgage in Brea with Summit Lending

Refinancing is a strategic option for Brea homeowners looking to lower monthly payments, shorten loan terms, or tap into home equity. With property values in Brea appreciating—Zillow reports a 6.2% increase in home values over the past year as of late 2023—now could be an opportune time to explore refinancing. Our loan calculator lets you compare current loan details with new terms to uncover potential savings. Here’s why refinancing in Brea might benefit you:

- Lower Interest Rates: If rates have dropped since your original mortgage, refinancing could save thousands. Freddie Mac notes that 30-year fixed rates averaged 6.5% in late 2023, though your rate depends on credit and market conditions.

- Adjust Loan Terms: Switch to a shorter term like 15 years to pay off faster, or extend to reduce monthly payments.

- Cash-Out Refinance: Leverage Brea’s rising home equity for renovations, debt consolidation, or other needs.

Summit Lending offers customized refinancing solutions for Brea residents. Learn more on our Refinance Loans page or contact us at 385-200-1470 to discuss your options.

How to Use Our Mortgage Loan Calculator for Brea Homes

Our user-friendly calculator provides quick, accurate estimates for Brea properties. Follow these steps to get started:

- Enter Loan Amount: Input the amount you plan to borrow for a Brea home purchase or the balance for refinancing.

- Select Loan Term: Choose terms like 15, 20, or 30 years.

- Input Interest Rate: Use the default rate based on current data or a specific rate if quoted.

- Add Additional Costs: Include Brea’s property taxes (approx. 0.75%), insurance, and PMI if applicable.

- View Results: See your estimated monthly payment, total interest, and amortization schedule instantly.

While our calculator offers a solid starting point, every mortgage in Brea is unique due to local market dynamics. For a personalized quote, contact us at 385-200-1470 or email [email protected]. You can also upload documents and apply directly via our secure portal at this link.

Why Choose Summit Lending for Brea Mortgages?

With over 50 years of combined experience, Summit Lending is committed to helping Brea residents and clients across California achieve their homeownership goals. Here’s what sets us apart:

- Local Expertise: We understand California’s housing markets, including Brea’s unique Orange County dynamics.

- Diverse Loan Options: From purchase loans to construction loans, reverse mortgages, and commercial loans, we’ve got you covered.

- Client-First Approach: Our brokers guide you every step of the way. See what clients say on our Testimonials page.

- Helpful Resources: Beyond calculators, we offer pre-approval support and guidance for first-time buyers.

Visit our About page to learn more about our mission. Though based in Tremonton, UT, at 305 E Main Street Suite 202, we’re just a call or email away for Brea clients.

Understanding Mortgage Factors in Brea, California

Mortgage costs in Brea vary due to local factors. Property taxes in Orange County average 0.75% of home value, slightly below the California state average of 0.77% (per the Tax Foundation, 2023). However, Brea’s high home prices often necessitate larger down payments or PMI for buyers. Additionally, homeowners insurance costs may be higher due to California’s wildfire risks, though Brea’s urban setting mitigates some of this compared to rural areas. The California Housing Finance Agency notes that first-time buyer programs and grants may be available in Orange County, which Summit Lending can help you access.

Our calculator helps factor in these costs, but for detailed insights into Brea’s market, connect with our loan officers. Stay updated with industry trends on our Blog.

Take the Next Step with Summit Lending in Brea

Ready to turn your mortgage calculations into action? Whether buying a home or refinancing in Brea, California, Summit Lending is your trusted partner. Start with our mortgage loan calculator, then reach out for a personalized consultation. Call us at 385-200-1470, email [email protected], or visit our secure application portal at this link. Our office in Tremonton, UT, may be miles away, but our commitment to Brea clients is unwavering.

Don’t let uncertainty stop you from achieving your homeownership or financial goals in Brea. With Summit Lending’s expertise, you’re never alone in this journey. Start calculating your mortgage today and take the first step toward a brighter future in Orange County!

Disclaimer: The results from our mortgage loan calculator are estimates based on input data and current market conditions. Actual loan terms, rates, and payments may vary. For precise quotes and loan approval, contact Summit Lending directly.