Calculate Your Mortgage Loans in Morgan, Utah

Rate History

Are you a first time Home buyer?

Our First Time Home Buyer Assistance Program is just what you need.Calculating Your Mortgage Loans in Morgan, Utah

Navigating the home-buying or refinancing process in Morgan, Utah, starts with understanding how to calculate your mortgage payments. This essential step aids in budgeting, planning for the future, and ensuring you can afford the home or loan terms that suit your needs. At Summit Lending, we’re dedicated to helping residents of Morgan and beyond make informed decisions about their mortgage options. This comprehensive guide will walk you through the mortgage payment calculation process, the tools available, typical costs, how much house you can afford, and strategies to lower your monthly payments.

Whether you’re eyeing a cozy family home in Morgan’s serene valley or considering refinancing to take advantage of better rates, knowing the financial aspects of your mortgage is key. Let’s dive into the details and explore how Summit Lending can support you every step of the way. For personalized assistance, don’t hesitate to contact us today.

How to Calculate Your Mortgage Payments

Mortgage payments are typically made on a monthly basis and consist of four main components, often referred to as PITI: principal, interest, taxes, and insurance. The principal is the portion of the payment that goes toward repaying the original loan amount. Interest represents the cost of borrowing that principal. Taxes are the property taxes assessed by local government entities in Morgan, Utah, and insurance includes homeowners’ insurance and, in some cases, private mortgage insurance (PMI) if your down payment is less than 20%.

Understanding these components is crucial for residents of Morgan, where property values and tax rates can vary based on proximity to natural attractions like the Wasatch Range or local amenities. By breaking down your monthly payment into these elements, you can better anticipate your financial obligations and plan accordingly.

Mortgage Payment Formula

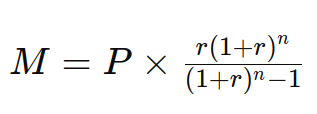

For a fixed-rate mortgage, which is a popular choice for its stability, the formula to calculate your monthly payment (M) is:

Where:

Where: - P is the principal loan amount

- r is the monthly interest rate (annual rate divided by 12)

- n is the number of payments (loan term in years multiplied by 12)

While this formula provides a foundational understanding, calculating manually can be complex due to varying interest rates and additional costs. That’s why we recommend using our Loan Calculator to input your specific details and get an accurate estimate tailored to the Morgan, Utah market.

Typical Mortgage Payment Costs in Morgan, Utah

The cost of your mortgage payment in Morgan, Utah, depends on several factors, including the loan amount, interest rate, loan term, and additional expenses like taxes, insurance, and possibly homeowners’ association (HOA) fees if you’re in a planned community. For example, a $300,000 loan with a 4.5% interest rate on a 30-year term might result in a monthly principal and interest payment of approximately $1,520. When you factor in Morgan’s property taxes (which average around 0.6% of property value annually, according to data from the Utah State Tax Commission) and insurance costs, the total monthly payment could increase significantly.

Property values in Morgan have seen steady growth due to its appeal as a quiet, scenic area with access to larger employment hubs like Ogden, just 20 miles away. This growth can impact loan amounts and associated costs. To get a precise breakdown of your potential mortgage payment, use our Loan Calculator and input relevant details such as principal, interest rates, APR, and insurance. For more insights into local market trends, reach out to our team at Summit Lending via our contact page.

How a Mortgage Calculator Can Help Morgan Residents

Mortgage calculators are indispensable tools for prospective homebuyers and those looking to refinance in Morgan, Utah. They offer several benefits, including:

- Estimating your monthly mortgage payments based on current rates and local data

- Understanding how fluctuations in interest rates or down payment amounts affect your payment

- Calculating the impact of extra payments on reducing your loan term and total interest paid

Using a mortgage calculator provides clarity in financial planning, especially in a market like Morgan, where home prices can range from $250,000 for starter homes to over $500,000 for larger properties near recreational areas like East Canyon State Park. This tool helps you visualize your future financial commitments and make informed decisions. Access our Loan Calculator today to start planning your home purchase or refinancing journey.

What Kind of Home Can You Afford in Morgan, Utah?

Determining how much house you can afford in Morgan, Utah, involves evaluating several factors: your income, existing debt, down payment savings, and current mortgage interest rates. A widely accepted guideline suggests that your monthly mortgage payment should not exceed 28% of your gross monthly income, while total debt payments (including the mortgage) should stay below 36% of your income. However, these percentages can vary based on personal circumstances and lender criteria.

In Morgan, the median household income is approximately $75,000, according to recent U.S. Census Bureau data, which can support a mortgage for a home in the $300,000 to $400,000 range, depending on other debts and down payment amounts. Additionally, Morgan’s cost of living is relatively lower than in nearby urban centers like Salt Lake City, making homeownership more attainable. For first-time buyers, Summit Lending offers specialized assistance through our First Time Home Buyers program to help navigate affordability and pre-approval processes. Contact us at 385-200-1470 or via our contact page to discuss your specific situation.

How to Lower Your Monthly Mortgage Payment in Morgan, Utah

Reducing your monthly mortgage payment can significantly ease the financial burden of homeownership or refinancing in Morgan, Utah. Here are several strategies to consider:

-

Larger Down Payment:

Increasing your down payment reduces the principal loan amount, lowering monthly payments and potentially eliminating the need for PMI. In Morgan, where home prices are competitive, saving for a 20% down payment can make a substantial difference. -

Longer Loan Term:

Choosing a longer loan term, such as 30 years instead of 15, spreads out the repayment period, reducing monthly payments. However, this increases the total interest paid over the loan’s life, so weigh the pros and cons. -

Refinance for Better Rates:

Refinancing at a lower interest rate can decrease your monthly payments and overall interest costs. Given the current market trends in Utah, refinancing could be a smart move for Morgan homeowners. Explore our Refinance Loans page for more details, and consider closing costs and your long-term plans before deciding. -

Property Tax Appeal:

If you believe your home’s assessed value is overstated, appealing your property tax assessment in Morgan County could lower your tax burden, thus reducing your monthly payment. Check with local authorities for the appeal process. -

Shop for Insurance:

Comparing homeowners’ insurance policies can help you find a more affordable rate, cutting down on monthly costs. Given Morgan’s low crime rates and minimal natural disaster risks, you might secure competitive insurance rates with some research.

Implementing one or more of these strategies can make homeownership or refinancing more manageable. Summit Lending’s experienced team is ready to help you explore these options. Visit our Loan Officers page to connect with a professional who understands the Morgan, Utah market.

Why Choose Summit Lending in Morgan, Utah?

At Summit Lending, we pride ourselves on over 50 years of combined experience in the mortgage industry, serving clients across Utah, including Morgan. Our local expertise allows us to offer tailored solutions for home purchases, refinancing, construction, reverse, and commercial loans. We understand the unique aspects of the Morgan real estate market. From the appeal of rural properties to the growth potential near urban corridors. And we’re committed to helping you secure the best mortgage terms possible.

Our services are designed to simplify the mortgage process. Whether you’re a first-time homebuyer needing guidance through pre-approval or a current homeowner exploring refinancing options, Summit Lending is your trusted partner. We’re based in Tremonton, Utah, but our reach extends to every jurisdiction in Utah, Idaho, Wyoming, and Texas, ensuring comprehensive support no matter where you are.

Ready to take the next step? Use our Loan Calculator to estimate your payments, or reach out directly by calling 385-200-1470 or emailing [email protected]. You can also visit our office at 305 E Main Street Suite 202, Tremonton, UT 84337, or explore more about our services on our About page.

Conclusion

Calculating your mortgage payments and understanding the factors that influence them are critical steps in the home-buying or refinancing process in Morgan, Utah. By leveraging tools like mortgage calculators, considering all associated costs, and exploring strategies to reduce monthly payments, you can make well-informed decisions that align with your financial goals. The goal isn’t just to buy or refinance a home. It’s to do so in a way that ensures long-term financial stability and peace of mind.

Morgan, Utah, with its blend of rural beauty and strategic location, is a fantastic place to invest in property. Summit Lending is here to guide you through every aspect of the mortgage process, from initial calculations to final approval. Don’t wait to start your journey. Visit our Contact Us page or call us at 385-200-1470 to speak with one of our expert loan officers today. Let us help you turn your dream of homeownership or financial optimization in Morgan into a reality.