Calculate Your Mortgage in 82008, Wyoming

Mortgage Solutions for 82008, Wyoming

At Summit Lending, we’re dedicated to helping residents of the 82008 zip code in Wyoming achieve their homeownership and financial goals. Located near Cheyenne, this area offers a unique blend of affordability, natural beauty, and a peaceful lifestyle, making it an ideal place to buy a home or refinance an existing mortgage. With median home prices in Wyoming around $330,000 as of 2023 (according to the Wyoming Association of Realtors), the 82008 area provides budget-friendly options compared to national averages. Low property taxes (averaging 0.6% of home value per the Tax Foundation) and no state income tax further enhance its appeal. Whether you’re a first-time buyer or looking to lower monthly payments through refinancing, our tools and expertise ensure a seamless process tailored to your needs.

Are you a first time Home buyer?

Our First Time Home Buyer Assistance Program is just what you need.Mortgage Loan Calculator for Home Purchases and Refinancing in 82008, Wyoming

At Summit Lending, we recognize that purchasing a home or refinancing a mortgage in the 82008 zip code, Wyoming, is a major financial decision. That’s why we’ve developed a user-friendly mortgage loan calculator to help residents of this Cheyenne-adjacent area estimate their monthly payments with precision. Whether you’re a first-time home buyer exploring affordable properties near the capital city, a current homeowner looking to upgrade, or seeking to reduce payments through refinancing, our tool delivers personalized results using up-to-date interest rates and loan terms. Based in Tremonton, Utah, Summit Lending proudly serves clients across Wyoming, Utah, California, Idaho, and Texas with over 50 years of combined experience in the mortgage industry. Let us guide you through the process in 82008.

Calculate Your Mortgage Loan Today

Understanding your mortgage payment is a crucial step in buying a home or refinancing in the 82008 zip code. Our mortgage calculator helps you budget effectively, confirm affordability, and plan for your financial future. Input your loan details to get a clear picture of your monthly obligations and long-term costs.

Breaking Down Your Mortgage Payment

Your monthly mortgage payment in Wyoming typically includes four key components, often referred to as PITI. Consider these when using our home loan calculator:

- Principal (P): The portion of the loan amount you repay each month.

- Interest (I): The cost of borrowing the principal, based on your interest rate.

- Taxes (T): Local property taxes, which in Wyoming are among the lowest in the nation at about 0.6% of home value annually (Tax Foundation, 2023).

- Insurance (I): Homeowners insurance and, if applicable, private mortgage insurance (PMI).

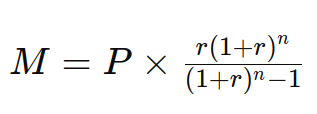

Mortgage Payment Formula with Our Calculator

Use this formula to estimate your fixed-rate home loan payment (denoted as 'M' for mortgage) each month:

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of payments (loan term in years multiplied by 12)

Expected Costs Based on Our Home Loan Calculator

For example, if you secure a 30-year loan for $250,000 at a 4% interest rate, your monthly payment for principal and interest would be approximately $1,193. Adding Wyoming’s low property taxes, insurance, and potential HOA fees (if applicable in 82008 subdivisions) will increase this total. Use our mortgage calculator at summitlending.com/loan-calculator for a detailed breakdown tailored to your situation in the 82008 zip code.

Why Use a Mortgage Loan Calculator for 82008, Wyoming?

Mortgages can be complex, with variables like interest rates, loan terms, down payments, and local taxes influencing your monthly costs. Our mortgage loan calculator simplifies this for residents of 82008 by providing clarity and actionable insights. Here’s why it’s a valuable tool:

- Estimate Monthly Payments: Enter your loan amount, interest rate, and term to see potential monthly costs.

- Compare Loan Options: Experiment with different terms, such as 15-year versus 30-year mortgages, to find what suits your budget.

- Account for Additional Costs: Include Wyoming-specific property taxes, homeowners insurance, and PMI for accurate estimates.

- Evaluate Refinancing Savings: See how a lower rate or adjusted term could reduce your payments over time.

Our calculator uses real-time market data to reflect current conditions, ensuring reliable results for 82008 residents. For personalized assistance, contact us at 385-200-1470 or via email at [email protected].

Home Buying in 82008, Wyoming

The 82008 zip code, located just outside Cheyenne in Laramie County, offers a compelling mix of affordability and access to urban amenities. As Wyoming’s capital, Cheyenne provides a stable economy with government jobs, healthcare, and proximity to F.E. Warren Air Force Base, making 82008 an attractive area for families and professionals. According to Zillow, the median home price in Cheyenne and surrounding areas like 82008 was approximately $325,000 as of late 2023, below the state median of $330,000 (Wyoming Association of Realtors). This affordability, combined with Wyoming’s lack of state income tax and low property tax rates, makes homeownership more attainable here than in many other states.

The 82008 area also offers a quieter, more rural feel compared to central Cheyenne, with access to open spaces and scenic views of the High Plains. For outdoor enthusiasts, proximity to Curt Gowdy State Park and Vedauwoo Recreation Area provides endless opportunities for hiking, camping, and fishing. Using our loan calculator, you can input local property values and interest rates to determine how much home you can afford in 82008. For more details on home buying, visit our Purchase Loans page or connect with our Loan Officers for expert guidance.

Refinancing Your Mortgage in 82008, Wyoming

Refinancing offers 82008 homeowners a chance to lower monthly payments, shorten loan terms, or tap into home equity. With interest rates fluctuating—averaging around 6.5% for a 30-year fixed mortgage as of late 2023 per Freddie Mac—now could be the time to explore options. Our loan calculator lets you compare your current loan details with new terms to identify potential savings. Consider these benefits of refinancing:

- Lower Interest Rates: If rates have dropped since your original mortgage, refinancing could save thousands over the loan’s life.

- Adjust Loan Terms: Switch to a shorter term like 15 years to pay off your home faster, or extend to reduce monthly payments.

- Cash-Out Refinance: Use equity for home improvements, debt consolidation, or other needs, especially valuable given steady home value growth in Cheyenne’s outskirts.

Summit Lending offers tailored refinancing solutions for 82008 residents. Learn more on our Refinance Loans page or reach out for a personalized consultation.

How to Use Our Mortgage Loan Calculator

Our intuitive calculator provides quick, accurate estimates for 82008 mortgages. Follow these steps:

- Enter Loan Amount: Input the amount you wish to borrow or your remaining balance for refinancing.

- Select Loan Term: Choose from terms like 15, 20, or 30 years.

- Input Interest Rate: Use the default rate based on current data or a specific rate if quoted.

- Add Additional Costs: Include estimates for Wyoming’s low property taxes, insurance, and PMI if applicable. Check Laramie County rates for accuracy.

- View Results: See your estimated monthly payment, total interest, and amortization schedule instantly.

While our calculator is a great starting point, individual mortgage needs vary. For a custom quote or to explore specific programs, call us at 385-200-1470 or email [email protected].

Why Choose Summit Lending for 82008, Wyoming?

With over 50 years of combined experience, Summit Lending is your trusted partner for mortgages in 82008 and across Wyoming. Here’s what sets us apart:

- Local Expertise: We understand Wyoming’s housing market, including unique factors in Laramie County and 82008.

- Diverse Loan Options: From purchase and refinance to construction loans, reverse mortgages, and commercial loans, we cover all needs.

- Client-First Approach: Our brokers guide you through every step. See client feedback on our Testimonials page.

- Helpful Resources: Beyond calculators, we offer pre-approval assistance and support for first-time buyers.

Located at 305 E Main Street Suite 202, Tremonton, UT, we’re just a call or email away. Learn more about us on our About page.

Understanding Mortgage Factors in 82008, Wyoming

Mortgage costs in 82008 are influenced by local conditions. Wyoming’s property taxes are among the lowest at 0.6% of home value (Tax Foundation), and no state income tax boosts affordability. However, rural areas like parts of 82008 may have limited lender options, making Summit Lending’s expertise critical. Home prices near Cheyenne have seen moderate growth due to demand for affordable housing near urban centers, per the Cheyenne Board of Realtors. Additionally, harsh Wyoming winters may increase insurance costs for homeowners. Use our calculator to factor in these elements, and consult our loan officers for tailored advice.

Take the Next Step with Summit Lending in 82008

Ready to move forward with your home purchase or refinance in 82008, Wyoming? Start with our mortgage calculator at summitlending.com/loan-calculator, then contact us for personalized support. Call 385-200-1470, email [email protected], or visit our Tremonton office. Explore more tips on our Blog. Don’t let uncertainty delay your goals—partner with Summit Lending to make homeownership a reality in 82008.

Disclaimer: Results from our mortgage calculator are estimates based on input data and current market conditions. Actual terms, rates, and payments may differ. Contact Summit Lending for precise quotes and loan approval.