Idaho Mortgage Calculator

Rate History

Are you a first time Home buyer?

Our First Time Home Buyer Assistance Program is just what you need.Mortgage Loan Calculator for Home Purchases and Refinancing in Idaho

At Summit Lending, we recognize that purchasing a home or refinancing a mortgage in Idaho is a major financial decision. That’s why we’ve developed a user-friendly mortgage loan calculator to assist residents across Idaho, from Boise to Pocatello, in estimating their monthly payments and budgeting effectively. Whether you're a first-time buyer in Nampa, looking to upgrade in Meridian, or aiming to reduce payments through refinancing in Twin Falls, our tool delivers personalized results based on current interest rates and loan terms. Based in Tremonton, Utah, Summit Lending proudly serves Idaho with over 50 years of combined expertise in the mortgage industry.

Calculate Your Idaho Mortgage Loan

Understanding how to calculate your mortgage payment is a critical step in the home buying process in Idaho. Using our mortgage calculator, available at Loan Calculator for Idaho, helps you budget accurately, confirm affordability, and plan financially for the future.

Components of Your Mortgage Payment

Your monthly mortgage payment in Idaho typically includes four key elements, often referred to as PITI. Consider these when using our home loan calculator:

- Principal (P): The amount you borrow and repay over time.

- Interest (I): The cost of borrowing the principal amount.

- Taxes (T): Local property taxes based on your home’s value in Idaho.

- Insurance (I): Homeowners and possibly mortgage insurance costs.

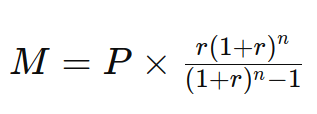

Mortgage Payment Formula for Idaho Home Loans

Use this formula to calculate your fixed-rate home loan payment each month with our calculator:

Where:

- P = Principal loan amount.

- r = Monthly interest rate (annual rate divided by 12).

- n = Total number of payments (loan term in years multiplied by 12).

Expected Loan Payment Costs in Idaho

For example, if you secure a 30-year loan for $300,000 at a 4% interest rate in Idaho, your monthly principal and interest payment would be approximately $1,432. Adding property taxes, insurance, and potential homeowners’ association fees will increase this amount. Use our mortgage calculator for a detailed breakdown tailored to your specific situation in cities like Boise or rural areas of Ada County.

Why Use a Mortgage Loan Calculator for Idaho?

The mortgage process can be intricate, with variables such as interest rates, loan terms, down payments, and Idaho-specific property taxes influencing your monthly costs. Our calculator simplifies this by providing clarity on what to expect. Here are key benefits of using our tool:

- Estimate Monthly Payments: Enter your loan amount, interest rate, and term to see potential monthly costs.

- Compare Loan Options: Test scenarios like a 15-year versus a 30-year mortgage to find what suits your budget.

- Account for Additional Costs: Include Idaho property taxes, homeowners insurance, and private mortgage insurance (PMI) if applicable.

- Evaluate Refinancing Savings: See how a lower rate or adjusted term could reduce costs over time.

Our calculator uses real-time data to reflect current market conditions in Idaho, empowering you to make informed decisions. For more tailored advice, connect with us via Contact Us.

Home Buying in Idaho

Idaho offers a compelling mix of affordability, natural beauty, and economic opportunity, making it a prime location for home buyers. From the bustling growth of Boise to the serene landscapes of Coeur d'Alene, Idaho caters to diverse lifestyles. According to the Idaho Realtors Association, the median home price in Idaho as of 2023 is around $450,000, with variations across regions. Boise and surrounding Ada County have seen price increases due to demand, while areas like Idaho Falls and Pocatello remain more affordable. The state’s low cost of living, averaging 7% below the national average as reported by the Missouri Economic Research and Information Center, combined with no state income tax on certain retirement incomes, makes Idaho attractive for families and retirees. Additionally, Idaho’s outdoor recreation, including access to Yellowstone National Park and the Snake River, enhances its appeal.

Using our loan calculator at Idaho Loan Calculator, you can input local property values and current rates to determine affordability in specific areas like Boise or Ada County. For detailed guidance, visit our Purchase Loans in Idaho page or speak with one of our Loan Officers.

Refinancing Your Mortgage in Idaho with Summit Lending

Refinancing offers Idaho homeowners opportunities to lower monthly payments, adjust loan terms, or tap into home equity. With fluctuating interest rates, now could be an ideal time to explore options. Our calculator lets you compare current loan details with new terms to identify savings. Here’s why refinancing might benefit you in Idaho:

- Lower Interest Rates: If rates have dropped since your original mortgage, refinancing could save significant amounts. Freddie Mac reports the average 30-year fixed rate in late 2023 at approximately 6.5%, varying by credit and market conditions.

- Adjust Loan Terms: Switch to a shorter term like 15 years to pay off faster, or extend to reduce monthly payments.

- Cash-Out Refinance: Use home equity for renovations, debt consolidation, or other needs, especially valuable in growing markets like Boise.

Idaho residents can access customized refinancing solutions through Summit Lending. Learn more on our Refinance Loans in Idaho page or contact us at 385-200-1470 for personalized assistance.

How to Use Our Idaho Mortgage Loan Calculator

Our intuitive calculator provides quick, accurate estimates for Idaho home buyers and homeowners. Follow these steps to begin:

- Enter Loan Amount: Input the amount you wish to borrow for a purchase or the remaining balance for refinancing.

- Select Loan Term: Choose from terms like 15, 20, or 30 years.

- Input Interest Rate: Use the default rate based on current data or enter a specific rate if quoted.

- Add Additional Costs: Include estimates for Idaho property taxes (averaging 0.7% of home value per the Tax Foundation), insurance, and PMI if applicable.

- View Results: See your estimated monthly payment, total interest over the term, and an amortization schedule.

While a great starting point, every mortgage scenario in Idaho is unique. For a custom quote or to discuss loan programs, reach out at [email protected] or call 385-200-1470.

Why Choose Summit Lending for Idaho Mortgages?

With over 50 years of combined experience, Summit Lending is dedicated to helping Idaho residents achieve homeownership and financial goals. Here’s what sets us apart:

- Local Market Knowledge: We understand Idaho’s housing trends, from Boise’s rapid growth to rural affordability in Bannock County.

- Diverse Loan Products: Beyond purchase and refinance loans, we offer construction loans, reverse mortgages, and commercial loans.

- Client-Focused Service: Our brokers guide you through every step. See client feedback on our Testimonials page.

- Helpful Resources: Access tools like our calculator, pre-approval assistance, and support for first-time home buyers in Idaho.

Located at 305 E Main Street Suite 202, Tremonton, UT, we’re ready to assist Idaho clients. Learn more about our team on the About page.

Understanding Mortgage Factors in Idaho

Mortgage costs and requirements vary across Idaho based on location. Key considerations include:

- Property Taxes: Idaho’s average property tax rate is about 0.7%, relatively moderate compared to national averages, per the Tax Foundation. Rates differ by county, with Ada County slightly higher due to urban demand.

- Home Price Trends: Boise’s median price exceeds $500,000 due to inventory shortages, while areas like Twin Falls remain below $400,000, per Idaho Realtors data.

- Rural vs. Urban: Rural Idaho offers lower prices but may have limited lender options. Summit Lending’s expertise ensures access to suitable loans regardless of location.

Our calculator helps factor in these costs, but for deeper insights specific to places like Kootenai County or Idaho Falls, consult our loan officers.

Additional Benefits of Working with Summit Lending in Idaho

At Summit Lending, we go beyond basic calculations to provide comprehensive support for Idaho residents. Our team is committed to transparency, ensuring you understand every aspect of your mortgage journey. We offer flexible consultation options, whether you prefer to meet in person at our Tremonton office or connect virtually from anywhere in Idaho. For those ready to proceed, upload documents and provide necessary information securely at this link to start your application process.

Idaho’s real estate market continues to evolve, with growth in tech and remote work driving demand in cities like Boise, as noted by the Idaho Department of Commerce. This trend increases the importance of securing competitive loan terms early. Our blog at Summit Lending Blog provides updates on market trends, tips for first-time buyers, and refinancing strategies tailored to Idaho’s unique landscape.

Moreover, Summit Lending partners with clients to explore state-specific programs, such as Idaho Housing and Finance Association initiatives, which offer down payment assistance and favorable terms for qualifying buyers. These programs can significantly reduce upfront costs, especially for first-time buyers in competitive markets like Meridian or Nampa. Our loan officers stay updated on these opportunities to maximize your benefits.

Take the Next Step with Summit Lending in Idaho

Ready to transform your mortgage calculations into reality? Whether purchasing a home in Meridian or refinancing in Coeur d'Alene, Summit Lending is your trusted partner. Start with our mortgage calculator, then contact us for a personalized consultation. Reach us at 385-200-1470, email [email protected], or visit our office in Tremonton, UT at 305 E Main Street Suite 202.

Explore additional resources and industry insights on our Blog. Don’t let uncertainty delay your homeownership or financial goals in Idaho. With Summit Lending’s expertise, you have a reliable ally. Begin calculating your mortgage today and take the first step toward a secure future.

Disclaimer: Results from our mortgage loan calculator are estimates based on provided information and current market data. Actual loan terms, rates, and payments may vary. For precise quotes and loan approval, contact Summit Lending directly.